In response to recent shifts by major studios to the theatrical exclusivity window, CMX Cinemas’ Chief Financial Officer Luis Castelazo is calling for a revision to film rental terms as movie theaters continue to grapple with a protracted recovery from the financial pitfalls of the Covid-19 pandemic.

The U.S. arm of Mexico’s Cinemex circuit, CMX Cinemas entered exhibition in the United States in April 2017 with its first location in Miami, Florida. The chain quickly grew to become the eighth-largest circuit in the North American market (U.S. and Canada) with 410 screens across 40 locations as of January 2020.

After closing temporarily closing its locations in March due to the onset of Covid-19, CMX became the first major U.S. circuit to file for Chapter 11 bankruptcy during the Covid-19 pandemic. At the time, CMX cited several factors for an eventual recovery, including capping studio claims on ticket sales at 40 percent and more amenable lease terms from landlords.

The circuit has since focused on restructuring its finances and began reopening locations in September. The circuit expects to add new locations in Naples, Florida, and McLean, Virginia in 2021.

Castelazo’s open letter to the industry is reprinted in its entirety below:

For decades, going to the movies has been one of America’s favorite pastimes. Exhibitors and movie studios have always worked together to provide an experience unlike any other to the communities we serve. Along with the commitment we have made to our vendors and to the thousands of local small businesses that supply our theaters (many of whom are at risk of losing their primary source of living), our commitment to our employees, our guests and our partners remains our top priority.

At CMX Cinemas, innovation has always been one of our core values. Our concept has evolved to provide an unmatched entertainment experience, with features such as laser projection, immersive sound, plush recliner seats, chef-driven offerings rivaling fine dining establishments, full bars with signature cocktails – all encompassed in a high-end, vibrant environment.

We understand not everyone is familiar with the nuances of the movie theater business and, as such, I feel obliged to clarify misperceptions about unilateral decisions adopted recently by some studios – and the severe impact these decisions will have not only on our industry and those who support it, but also on a century-old pastime enjoyed by so many: the unbeatable magic of experiencing a film on the big screen.

The facts matter:

Over the past several decades, movie studios have required movie theater chains to pay a higher and higher share of each movie ticket sold – commonly referred to as “film rental.” To illustrate this, the share of film rental in the U.S. has increased from approximately 27% in 1970(1) to 57% in 2019(2), driven by the studio’s hegemonic power. Movie theater chains have had no other option but to pay a higher share for each ticket sold – or go out of business. In spite of this, the movie theater industry has existed for over a century, and guests have continued to enjoy new movies on the big screen. At CMX Cinemas in particular, our guests have been captivated by our additional VIP offerings.

Through the years, not much has changed in how film rental agreements work. However, the pandemic has had a profound impact on the movie industry as a whole, allowing some studios to make unprecedented moves: showing premiere movies simultaneously on streaming platforms and in theaters. This completely changes the rules of the game – as movie theater attendance will undoubtedly be affected. For this reason, CMX Cinemas is engaging in conversations with studios to reach an agreement beneficial to both the industry and the customer.

The average ticket price in the U.S. is approximately $9, of which approximately $5 is paid to studios as film rental(2). In other words, movie theaters earn an estimated $4 per ticket at the box office, of which approximately $2 covers labor and approximately $2 goes to the landlord – basically leaving cinemas with earnings of popcorn, candy, beverages, and food items, much more like a restaurant or bar, to cover other operating expenses and be able to realize a return on its investment (the investment is typically much higher for a theater than for a restaurant or bar).

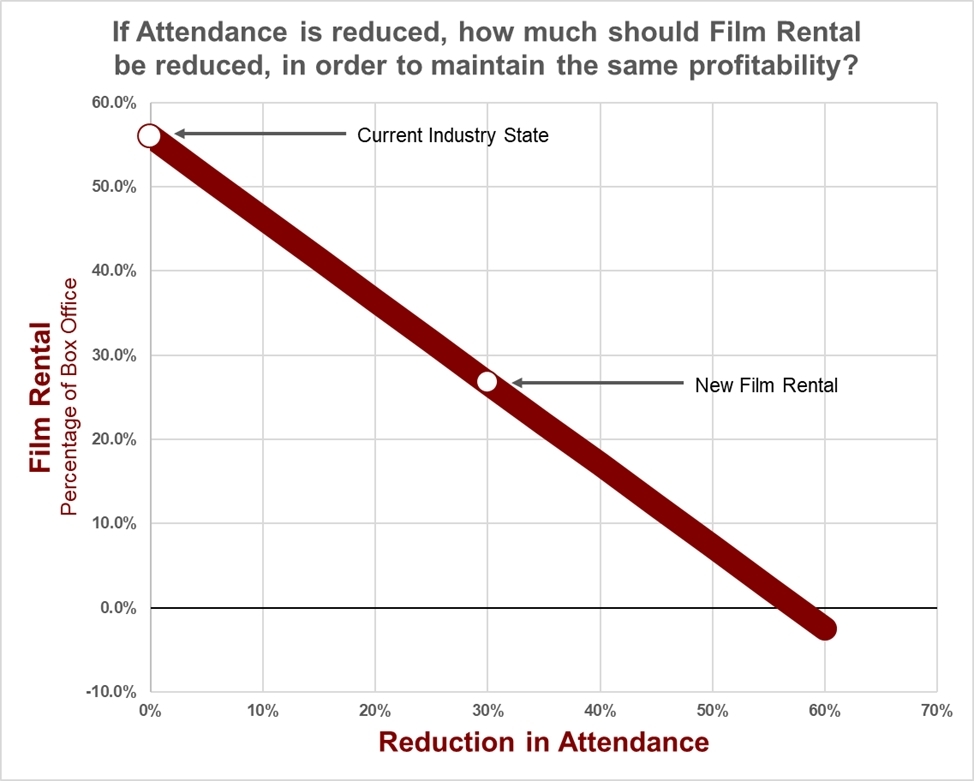

If studios show their movies on their own streaming platforms at the same time as in theaters, naturally, attendance in theaters will suffer, and revenues will shrink. An analysis by CMX Cinemas shows that attendance in theaters will be reduced by at least 30% in the opening weeks, and therefore film rental should be back to approximately 27% or less in order to ensure actual theater profitability is unaffected.

So, how can an industry survive if a large percentage of its attendance and profit vanishes? At CMX Cinemas, we believe that film rental should be reduced from the current 57%(2) if the ‘window’ (number of days between theater release and streaming platform release) is drastically reduced or eliminated. If there were a 50% attendance loss, it would require theaters to pay a 7% film rental to maintain profitability; studios will compensate for the film rental reduction via their streaming platform fees.

In the end, the movie theater industry is about partnerships: we partner with studios and landlords to offer guests an experience unmatched at home or on a mobile device. CMX Cinemas is committed to renewing this partnership agreement to provide the best experience to customers and to promote the industry. CMX Cinemas, through its successful reorganization process, was able to reach agreements with landlords – developing an unprecedented fair rent structure. It is now the time for the studios to engage in partnerships that allow us to continue offering the best movie-going experience to our guests.

(1) Entertainment Industry Economics: A Guide for Financial Analysis, by Harold L. Vogel Page 88.

(2) Average of U.S. Operations of publicly traded movie theater companies, as presented in their US SEC Filings of 2019.

Share this post