2020 marks the 100th anniversary of the founding of Boxoffice Pro. Though the publication you hold in your hands has had different owners, headquarters, and even names—it was founded in Kansas City by 18-year-old Ben Shlyen as The Reel Journal, then called Boxoffice in 1933, and more recently Boxoffice Pro —it has always remained committed to theatrical exhibition.

From the 1920s to the 2020s, Boxoffice Pro has had one goal: to provide knowledge and insight to those who bring movies to the public. Radio, TV, home video, and streaming have all been perceived as threats to the theatrical exhibition industry over the years, but movie theaters are still here—and so are we.

We at Boxoffice Pro are devotees of the exhibition industry, so we couldn’t resist the excuse of a centennial to explore our archives. What we found was not just the story of a magazine, but the story of an industry—the debates, the innovations, the concerns, and above all the beloved movies. We’ll share our findings in our year-long series, A Century in Exhibition.

The experimental revolution that swept the 1960s and 1970s was all but dead and buried in the ’80s. Summarizing the new decade, Peter Biskind, author of Down and Dirty Pictures, writes, “When the Ronald Reagan tsunami swept everything before it, the market replaced Mao, The Wall Street Journal trumped The Little Red Book, and supply-side economics supplanted the power of the people.” The corporatization of Reagan’s America, as well as its return to conservatism, left Hollywood with little interest in small, realistic, auteur-driven films. Instead, it went all-in on megabuck movies produced by mega-corporations to be shown in megaplexes.

The Return of the Studios

Riding the blockbuster wave started by Jaws and Star Wars in the previous decade, Hollywood in the 1980s turned all its efforts to the production of expensive sci-fi, action, and horror blockbusters like Raiders of the Lost Ark and E.T. What Jaws had taught the industry was not only the power of pricey special effects but also that of huge marketing campaigns. Skyrocketing marketing budgets significantly inflated the price of films in the 1980s. The MPAA’s president, Jack Valenti, revealed in November 1980 that in that year the average film made by the major studios that made up the MPAA cost $10 million before advertising and prints, double the 1975 figure. Prints and advertising added another whopping $6 million. According to Valenti, box office grosses needed to reach about $40 million for the studio to simply break even.

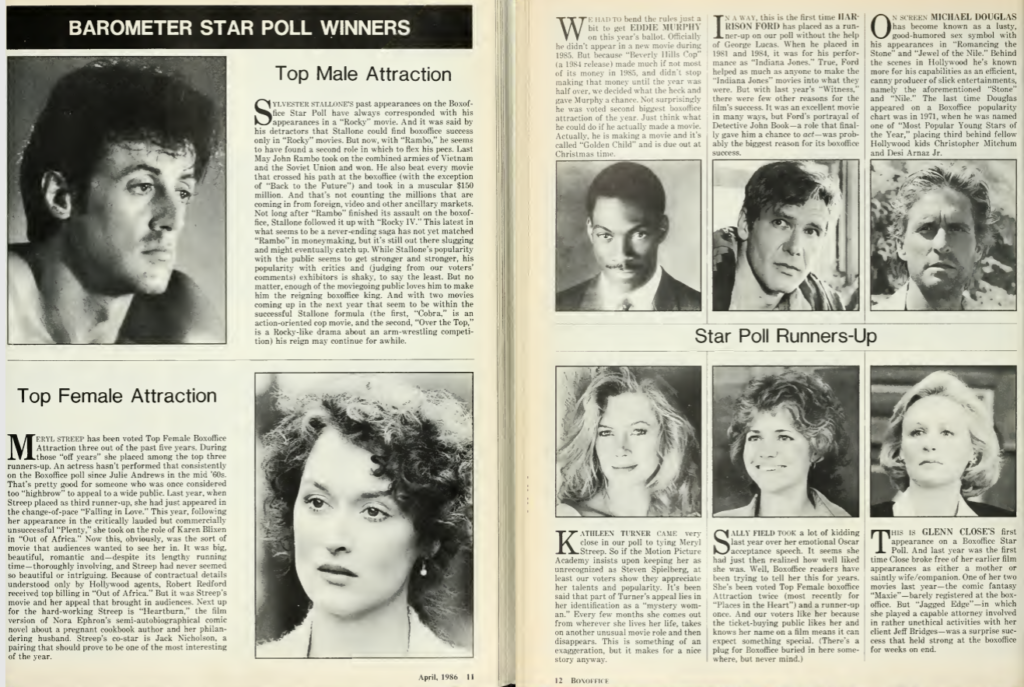

To guarantee maximum returns, Hollywood’s high-concept blockbusters became more and more homogenized. Unlike the popularity of little-known actors or even nonactors in the’60s and ’70s, the studios increasingly relied on a small number of very popular actors with a star factor strong enough to make people show up at the box office. Boxoffice Pro even began publishing “box office attraction” lists, with the most popular stars and the most promising new actors based on monthly surveys. Studios also invested heavily in sequels to minimize risks. Associate editor Jimmy Summers wrote somewhat ironically about the trend in the summer of 1983, when films like Return of the Jedi, Rocky III, Superman III, and Psycho II hit the screens. The “summer of sequels appears to be the season in which the actors do exactly what their public wants them to do,” he wrote.

Higher production and marketing costs proved a problem for exhibitors, which were forced to raise their ticket prices sometimes to as high as $6 or $7, doubling the 1970s prices. Between 1979 and 1980, when the average ticket price was $2.69, the MPAA reported a 6.9 percent increase in the average ticket price. Exhibitors found themselves squeezed between higher print costs, larger margins for studios, and the fear of losing their patrons. Boxoffice Pro editor Alexander Auerbach, who took over from magazine founder Ben Shlyen as editor in 1979, urged the industry to control its costs and pointed out the studios’ hypocrisy in an editorial published in June 1982. “If the major studios cannot turn out a steady flow of films for less than $10 million each, how do they propose to make them for cable-only distribution for $3 million or less?” he wondered.

Big Business Entertainment

The financial changes of the 1980s made it harder and harder for small studios and exhibitors to survive. Instead, vertically integrated media conglomerates, well equipped to finance and distribute these movies, ushered in the era of big-business entertainment. Acquisitions of studios by nonmedia conglomerates had started in the 1960s, but the 1980s was a time of unprecedented media cross-ownership, vertical integration, and the increasing importance of financial instruments like equity, shareholder value, and other financial assets during a period of unprecedented deregulation.

In 1982, Coca-Cola, a longtime partner of theaters, entered the industry aggressively when it bought Columbia Pictures for a reported $750 million. It marked the first takeover of a major Hollywood studio by a conglomerate since Kinney National Services acquired Warner Bros.-Seven Arts, Gulf & Western bought Paramount, and Transamerica took control of UA in the late 1960s. In 1983, Columbia, HBO, and CBS joined forces to create Tri-Star (later TriStar), a new studio that would produce films for theatrical exhibition and cable TV. A year later, Tri-Star bought the Loews theater chain, raising antitrust concerns in regard to a potential violation of the Paramount Decrees. In 1987, Japanese electronics giant Sony moved into theatrical distribution to enhance its video sales with the creation of AIP Distribution. Two years later, in September 1989, Sony Corporation of America purchased Columbia Pictures and Tri-Star from Coca-Cola and renamed itself Sony Pictures Entertainment.

Sony’s acquisitions opened the way for foreign ownership of studios, amplifying American anxieties about a “foreign invasion.” The Qintex Group of Australia had bought MGM/UA earlier in 1989, topping the bid of Australian publisher Rupert Murdoch, who had acquired 50 percent of 20th Century Fox in 1985. But what the Sony acquisition ultimately showed was the advantages it gave to Sony, which was now the sole company controlling its films’ content, distribution channels, and the hardware with which people could watch movies at home (VCR, laser disks, etc.).

Exhibition did not escape the M&A trend, despite the Paramount Decrees. Sony held the historic chain Loews, which was briefly renamed Sony Cinemas before switching back to its original name. Warner Communications and Gulf & Western formed Cineamerica Theaters, a corporate entity that took over Gulf & Western’s Mann Theaters, Festival Enterprises, and Trans-Lux circuits. Finally, MCA, the parent company of Universal, purchased a 49 percent stake in Cineplex Odeon in 1986.

While most acquisitions were not the subject of commentary by the editorial team, Boxoffice Pro’s new editor, Harley W. Lond (who took over in 1984 and implemented a significant overhaul that put more editorial emphasis on “vital analysis and interpretation” rather than straight news), deplored the trend. In an August 1989 editorial, he wrote, “The conglomeration fever in our industry has now moved from the acquisition of exhibition outlets to the acquisition of production outlets, and this does not augur well for us. Just recently, George Lucas bemoaned the rash corporate takeover by stating that such actions ‘damage the creative energies of the entertainment industry’ by creating companies with enormous debts, thus tying up resources that should be made available instead for risk-taking on new films, filmmakers, and new ideas.”

The survival of smaller and independent theaters who struggled to stay afloat was at stake. Boxoffice Pro dedicated a lot of space to independent distribution and exhibitors, publishing regular strategy columns and profiles of distributors and cinemas. A few indies managed to thrive, most notably New Line Cinema with the hit A Nightmare on Elm Street and Miramax with Sex, Lies, and Videotape, as well as exhibitors like Carmike Cinemas, Pacific Theaters, and the Laemmle chain. But as Dan Harkins, president of Arizona’s Harkins Theaters, put it in December 1987, independents were still “facing extinction” because of conglomerate buy ups. Independent exhibitors were at the forefront of the fight against integration, often pushing for resolutions through NATO. In fact, Boxoffice Pro reported that in August 1987, Dan Harkins, as well as other exhibitors from Texas and Indiana, appeared in front of New York’s District Court to prevent Tri-Star from having the right to book its films into its Loews cinemas. Despite their efforts, the court granted Tri-Star its request.

Home Entertainment, VCR Wars, and MTV

Vertical concentration was not the only challenge facing the exhibition industry in the 1980s. Editor Alexander Auerbach had summed up the threat of home entertainment in a March 1981 editorial. “Exhibition and the studios, which once feared the advent of television, now ponder on the impact of cable TV, pay-TV, the videodisc, and videotape, direct broadcast from satellite to home and other technological advances. All of this new gadgetry can be regarded as either an opportunity or a threat, but in either case, it cannot be ignored,” he argued. As had happened since the advent of TV in the ’50s, theaters were competing for the scarce time, attention, and cash of a moviegoing audience that now had a seemingly never-ending bounty of home alternatives.

One significant threat in home entertainment was the rapid quality improvements in TV screens and surround systems at home. Echoing the race to large formats in the ’50s, as readers of this column might remember, Tony Francis, president of Theater Products International and regular Boxoffice Pro contributor, lamented in May 1981 that “the picture only offers size.” He feared that although the quality of TV pictures was inferior to film, it would soon surpass it. Francis urged exhibitors to get ready for the competition and reminded readers that only 15 percent of American theaters offered stereophonic sound in 1981, while consumers were getting more and more accustomed to it—and therefore expecting it—at home via their radios, tape players, and headphones. In September of that year, Ioan Allen, Dolby’s vice president of marketing, warned in Boxoffice Pro that as much as 90 percent of theaters were subpar in sound and/or projection compared to home equipment. Innovations in HDTV technologies made the threat even more imminent. It is interesting to note that Francis Ford Coppola’s Zoetrope Studios was actually involved in HDTV demos, as he believed that the next logical step would be to distribute films made on tape via satellite to theaters.

The videotape craze was an additional challenge to exhibitors, especially after the mid-1980s. Introduced in the American market in the ’70s, Sony’s Betamax and JVC’s VHS were fiercely competing to dominate the videocassette and videocassette-recorder industry. Boxoffice Pro published a study by the Electronic Industries Association’s Consumer Electronics Group in 1985 showing that sales of VCRs had jumped over 72 percent year-over-year. The jump was preceded by the Supreme Court’s Sony Betamax Decision in March 1984, which ruled that home-videotaping practices were not in violation of copyright laws. In an unprecedented move, Boxoffice Pro extended its coverage to video with its “Boxoffice Video Supplement,” starting in 1985, in an effort to inform exhibitors of the trends and potential uses of this new format. Soon, cassette and VCR sales outpaced domestic box office grosses. According to a report in the Video Supplement in 1987, income from videocassette sales rose 30 percent compared to 1986 and, at $7.46 billion, nearly doubled the $4.2 billion total box office take for that same year.

On top of home-entertainment quality improvements and the VCR menace, the ’80s saw the explosion of cable TV. It was no coincidence that all major media and exhibitor conglomerates rushed to acquire premium channels. For instance, in 1983 MCA, Paramount, and Warner agreed to become partners to buy the Movie Channel, a satellite-delivered motion picture pay-TV service with over 2 million subscribers at that time. Four years later, the late Sumner Redstone, owner of National Amusements—which operated 400 movie centers—bought a controlling interest in Viacom, which owned MTV and Showtime. For exhibitors, the danger was not just a relentless competition for audiences. As Perry Lowe, chairman of the board of the National Association of Concessionaires, explained in a 1981 piece, because of inflation and the different cost structures of the industry, “theater owners would have to raise prices faster than cable operators, and the result will be a further widening gap between the value of seeing a movie at home on cable TV versus going out to a movie theater.”

Overall, however, the response of exhibitors toward these new threats was not quite as anxiety ridden as it had been in previous decades. Exhibition had survived despite countless doom-and-gloom predictions in the past. This time around, many Boxoffice Pro writers and contributors were quick to point out how ancillary markets could incentivize filmmaking and present new opportunities for returns. Jack Valenti noted in 1982 that while some 40 percent of television homes were equipped with cable, 18 million subscribed to pay TV or cable movie channels, and 4 million video recorders were in the nation’s living rooms, the year had still recorded an all-time-high box office record. The reason behind this, he argued, was simple: People who love movies love them in every medium.

Industry experts reassured exhibitors by stressing the opportunity for an aggressive promotion provided by pay TV and cable. One such example was “Movieweek,” a half-hour program on MSN Information Channel that used an MTV-like model to put movie marketing (including trailers and interviews) into thousands of homes. Video was also presented as a medium to attract audiences who did not go to the movies at all. “Home video is actually a blessing to exhibitors, because it’s tapped into the people who are not contributing to Hollywood film production,” explained Dan Harkins in October 1985. A businessman in the videocassette field went even further in a 1981 article: “[Exhibitors] possess a knowledge that no other group of businessmen have in this country. They know motion pictures and how to sell them. It follows that they are the best-prepared group to become video cassette and disc retailers.” Auerbach agreed in a 1984 editorial, stating that “the rental business is a bit different from the usual snack bar activity, but hardly an overwhelming challenge to the theater employee.” Indeed, a few small theaters presented in the magazine, like Fred Kaysbier’s theater in Ogallala, Nebraska, or the Village Theater in Knoxville, Iowa, turned to video sales.

The Window Issue

What also concerned exhibitors was the matter of theatrical exclusivity windows. Talks about windows went back to the birth of TV, but the ’80s was the decade that saw the issue become much more prevalent in the magazine’s coverage. The editorial line was clear. “Exhibition must battle to preserve its place as the first-run outlet for product from Hollywood,” wrote Auerbach in November 1980, following an unofficial NATO convention in New Orleans dedicated to the topic. Auerbach was especially concerned by the ever-shrinking window between theatrical releases and cassette releases, noting that some videocassettes were released while films were still in theaters. That was not only true for smaller films but for bigger box office successes like Purple Rain, which became available on tape only six months after its initial theatrical release.

“What became of the unwritten rule of a one-year window (now ostensibly six months but, in reality, four-or-less months) on film to videotape transfers?” asked editor Harley W. Lond in December 1984. He noted that distributors, benefiting from word of mouth from theatrical releases, were eager to shorten the windows further. Subsequent-run theaters were hit the hardest. Auerbach wrote, in May 1984, that “a reasonable ‘window’ between theatrical and cassette release would at least help the first-run houses, although sub-run theaters would still have a tougher row to hoe.” The observation was echoed by George Kerasotes, president of Kerasotes Theaters, who in 1981 declared, “I don’t think there’ll be subsequent-run theaters—neighborhood houses that run pictures for a long time—because that market is rapidly being absorbed by cable TV people, cassettes, disks, whatever is coming out.”

Movie Palaces and Megaplexes

In the aforementioned editorial, Harley W. Lond urged exhibitors to unite and put pressure on their suppliers while also increasing their investments in state-of-the-art technology to provide “a form of entertainment that can’t be matched anywhere else.” He underlined a widespread criticism of the exhibition industry. Despite all the novel technological threats to be found in the home video market, the biggest threat for some exhibitors was exhibitors themselves. “Badly maintained theaters with poor acoustics, dim screens, scruffy decor, and butchered prints will do more to keep potential ticket buyers away than any of the electronic marvels now on the market,” reported Boxoffice Pro after a 1981 NATO convention in Las Vegas. The shopping center multiplex model was already starting to feel lackluster and antiquated. “The multiplex has become the Japanese car of the movie theaters—compact, efficient, and often lacking in individual style,” wrote Tom Matthews, managing editor, in 1989.

The movies needed to bring their magic back. Jack Valenti put it simply in 1986: “Theater box office and the magic of the movies in the marketplace are irretrievably linked together. One goes down as the other diminishes. One goes up as the other shines.” A new type of theater was to bring back the magic: the megaplex. Giant modern theater complexes began overtaking smaller multiplexes after the mid-’80s, with Kinepolis Brussels opening the world’s first megaplex with 25 screens in Belgium in 1988.

The path toward the megaplex era is well documented in Boxoffice Pro. That history cannot be told without the Canadian Cineplex Odeon Group and its president and founder, Garth Drabinsky. Drabinsky and Nathan A. Taylor founded Cineplex Odeon in 1979. By the end of the decade, according to the magazine’s new Giants of Exhibition list, it had become North America’s fourth-largest circuit, with more than 1,500 screens in the U.S. and Canada. Megaplexes were often located in malls—epitomized by the 1,000-seat Cineplex Beverly Center in Los Angeles—but a new trend of stand-alone buildings with multiple amenities was becoming more and more prevalent. For example, Cineplex Odeon’s flagship location in Universal City, located next to Universal Studios and its theme park, was built in 1987 with 18 screens and 6,000 seats for $16.5 million. In a speech at a NATO convention in 1988, Drabinksy highlighted the rationale behind the megaplex. He stressed “the urgent necessity of formulating the most felicitous motion picture viewing ambiance that the present technology and the most creative architectural designs will permit.”

The megaplexes were meant to offer a luxurious experience to moviegoers. They were often inspired by the movie palaces of yore, and those classic theaters’ visionary architects—like Samuel “Roxy” Rothafel, Thomas Lamb, and the Rapps—were often referenced in megaplex profiles. “Lobbies and auditoriums are leaning more towards palatial furnishings rather than the shopping centers crackerbox floor plans of yesteryear,” wrote Dan Harkins in 1987. This state of mind perhaps explains why so many pages of Boxoffice Pro in the ’80s were dedicated to profiles of restored movie palaces. The megaplexes were also designed to optimize the patron’s viewing and comfort, which meant that Dolby Stereo surround systems and the Lucasfilm THX sound system were a must. To help exhibitors navigate the countless innovations and new terms, the magazine’s Modern Theater section ramped up its coverage on sound, at a rate comparable to the 1920s when sound was first introduced.

The whole idea behind megaplexes and the fight against home entertainment was to make moviegoing an “experience.” Concessions became an integral part of that strategy, as many theaters expanded their menus to offer more specialty concessions, like beer and wine, larger sizes (32-oz. sodas were dwarfed by 45 and 60-oz. cups), and combos. Merchandising tie-ins started booming. The Star Wars licensing and merchandising success made exhibitors jump on the bandwagon, and many started selling licensed T-shirts, posters, records, videocassettes, toys, and other paraphernalia at the concessions stand. Exhibitors hoped to increase their profits and translate the “buzz” of satisfied moviegoers into impulse buys once the movie was over. This was especially the case with children’s movies. As one exhibitor put it in 1988, “We’ve sold a lot of Roger Rabbit pins at our theaters. But we tried to merchandise Rambo and just didn’t have any luck.” Inspired by the fast-food industry, Coca-Cola, which had bought Columbia Pictures in 1982, was a pioneer in that strategy and put in place multiple promotional tie-ins on reusable cups and popcorn buckets. “The more hot properties developed for the screen, the better. All the promotion and all the hype on only one hot picture a year will cause the theater industry to go painfully soft,” explained Herbert Arnold, V.P. of Coca-Cola USA in a 1980 interview.

Pioneering the Computer Age

In 1989, Coca-Cola introduced its self-serve, walk-through concession stand, which was manufactured by Cretors, the inventor of the popcorn machine. Coca-Cola was bringing to concessions one of the most important developments in the exhibition industry: automation. While articles on automation had occasionally been featured in Boxoffice Pro since the 1950s, modern automation as we know it today took off in the ’80s. “There’s nothing romantic about a ticket machine. (…) But automation has hit the box office, and theaters that don’t modernize their operations will suffer,” warned Auerbach in June 1981. To help exhibitors understand the new technological tools at their disposal, a “Computers” special section was introduced in the Modern Theater section in the 1980s, discussing benefits, usage, costs, and products associated with computers.

Automated ticketing systems, such as Omniterm, Dataticket, and Movie/Master, were often advertised and explained in the magazine. The ability to print tickets faster and provide all the information necessary to the moviegoer on the ticket while also keeping track of sales was a tremendous innovation for exhibitors. These systems also allowed customers to reserve tickets earlier by phone and to pay with major credit cards. More and more software products, such as Theatron All in One, became integrated with concession sales, programming, bookkeeping, and even booth and auditorium management.

The ’80s also saw the development of online databases meant to manage releases and marketing material. Two of the database services profiled in Boxoffice Pro were Baseline, which gave access to weekend box office reports and information on upcoming movies, and Cinemascore, which provided demographic data on opening-night audiences. In December 1988, the magazine decided to extend its services to the digital space with Boxoffice OnLine, a computer service meant to provide exhibitors with vital information—like teasers, trailers, and changing release dates—more quickly than it could be delivered in print.

Computers also became an integral part of an effort to systematically use data to understand consumer behavior and tastes. One contributor summed up the need for more research on the moviegoer’s motivations to watch a movie within such a fragmented media landscape. “Today’s film patrons don’t go to the movies, they go to a movie,” he wrote, arguing that predictions and data were more necessary than ever. Software like Entertainment Data and Market Relay Systems was developed to predict which films would be hits, thus helping exhibitors guide scheduling. To quote Tom Matthews, managing editor in September 1989, with more money at stake than ever before for both studios and exhibitors, “the motion picture industry [had] become a numbers game.”

By the end of the decade, the industry was optimistic. At the NATO/ShoWest 1989 Convention, NATO president William Kartozian cited a 20-year upward trend in both screens and revenues—the former increasing from 13,000 to 24,000 venues, an 80 percent increase, and the latter rising from $1.2 billion in annual grosses to $4.4 billion, a 27 percent increase. In this context, the trends adopted in the ’80s—from IP-based event films to moviegoing as an experience, vertical integration, and automation—were to become the bedrock of the industry for subsequent decades.

Share this post