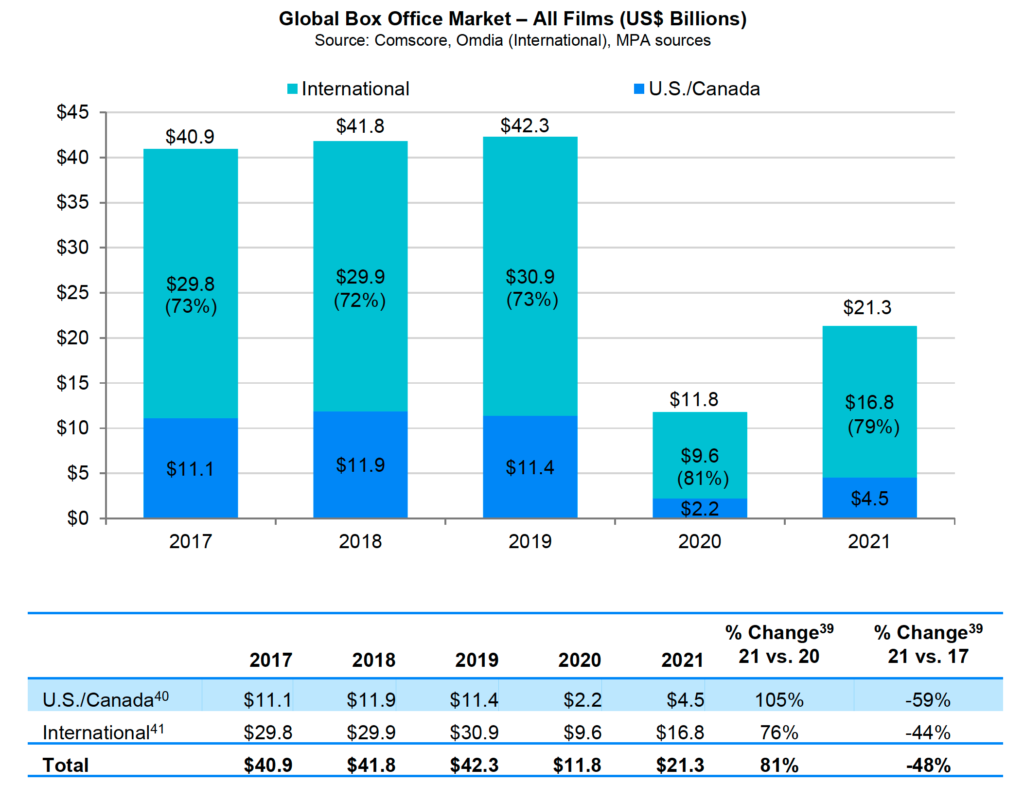

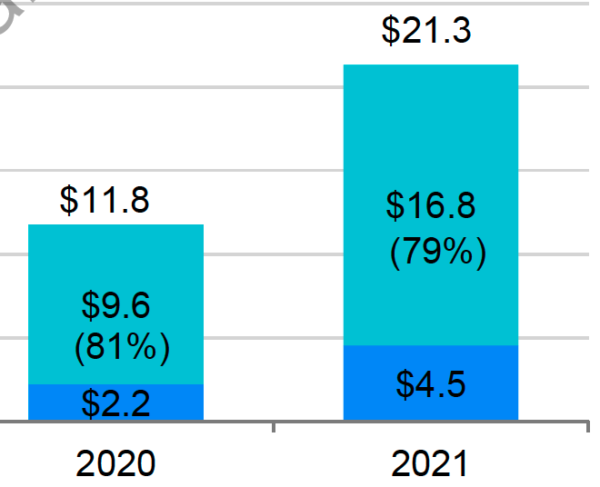

The global box office rebounded to $21.3 billion in 2021, an 81 percent increase from 2020’s disastrous figures, according to the Motion Picture Association’s (MPA) annual Theatrical and Home Entertainment Market Environment (THEME) report.

The year-over-year improvement was sorely needed in an industry that continues to feel the impacts of the Covid-19 pandemic. Though promising, the figure is still roughly half of the industry’s record global box office profits of $42.3 billion in 2019. Worldwide ticket sales had brought in over $40 billion in revenue for the three consecutive years leading up to 2020. The pandemic derailed that momentum, and the box office sputtered to $11.8 billion (a nearly 75% drop) in a year marked by release cancellations and cinema closures.

2021 was never expected to see a full recovery for cinemas, but it did present an important opportunity to win back audiences after sustained closures across multiple markets. “As the Motion Picture Association marks its 100th anniversary this year, our latest THEME Report underscores how resilient and dynamic our industry is, and I couldn’t be more optimistic about the future of our business,” said Charles Rivkin, chairman and CEO of the Motion Picture Association, in a press release announcing the year’s results. “We are just getting started in writing the next chapter of our industry as streaming continues to boom, theaters are rebounding, and the overall global market for our entertainment product recovers and breaks records. Our members are the most innovative companies on earth. Their capacity to bring people together through the timeless magic of extraordinary stories will continue to captivate billions of viewers over the next 100 years.”

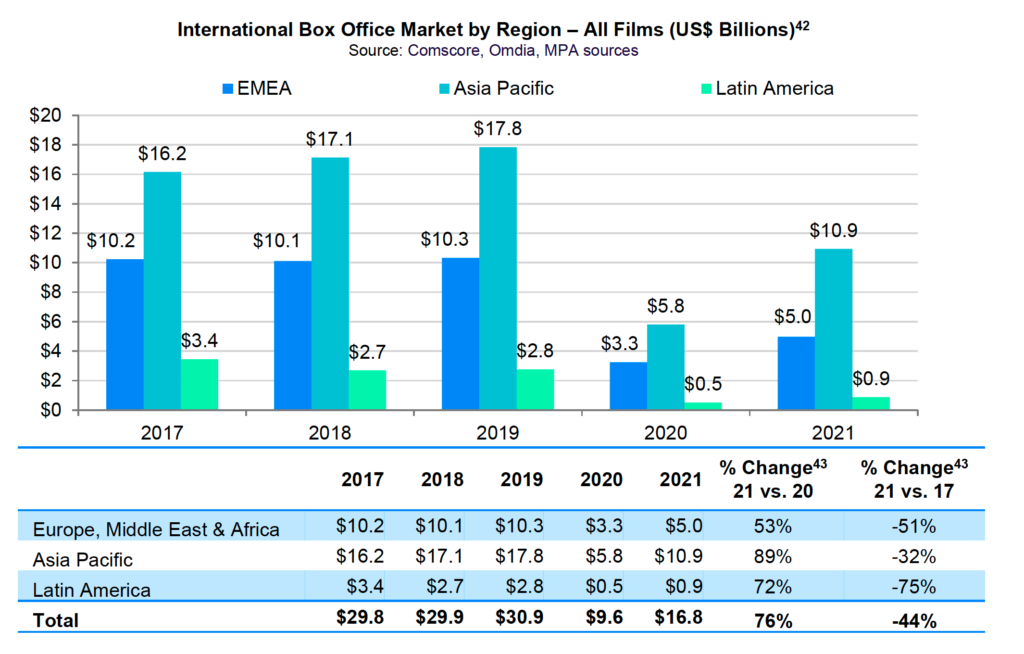

The international box office accounted for 79 percent of global admissions revenue in 2021, led by another strong year from China. The Chinese market first claimed the world’s box office crown in 2020 thanks in large part to a consistent slate of domestic titles upon cinemas’ reopening. That streak continued into 2021, with China reaching $7.3 billion in annual ticket sales, a $4.4 billion bump from 2020.

China’s leadership position buoyed the Asia Pacific region to $10.9 billion. Japan was the only other market to join China and North America in registering over $1 billion in theatrical box office sales during the year. In 2019, a total of 10 markets crossed $1 billion in box office.

Europe, Middle East & Africa (EMEA) recovered to slightly under half its pre-pandemic levels, finishing the year with $5 billion. Latin America, unable to reach the $1 billion mark for a second consecutive year, suffered more than any other global region during its recovery year. Cinemas in Latin America only managed to achieve roughly one-third of their pre-pandemic box office.

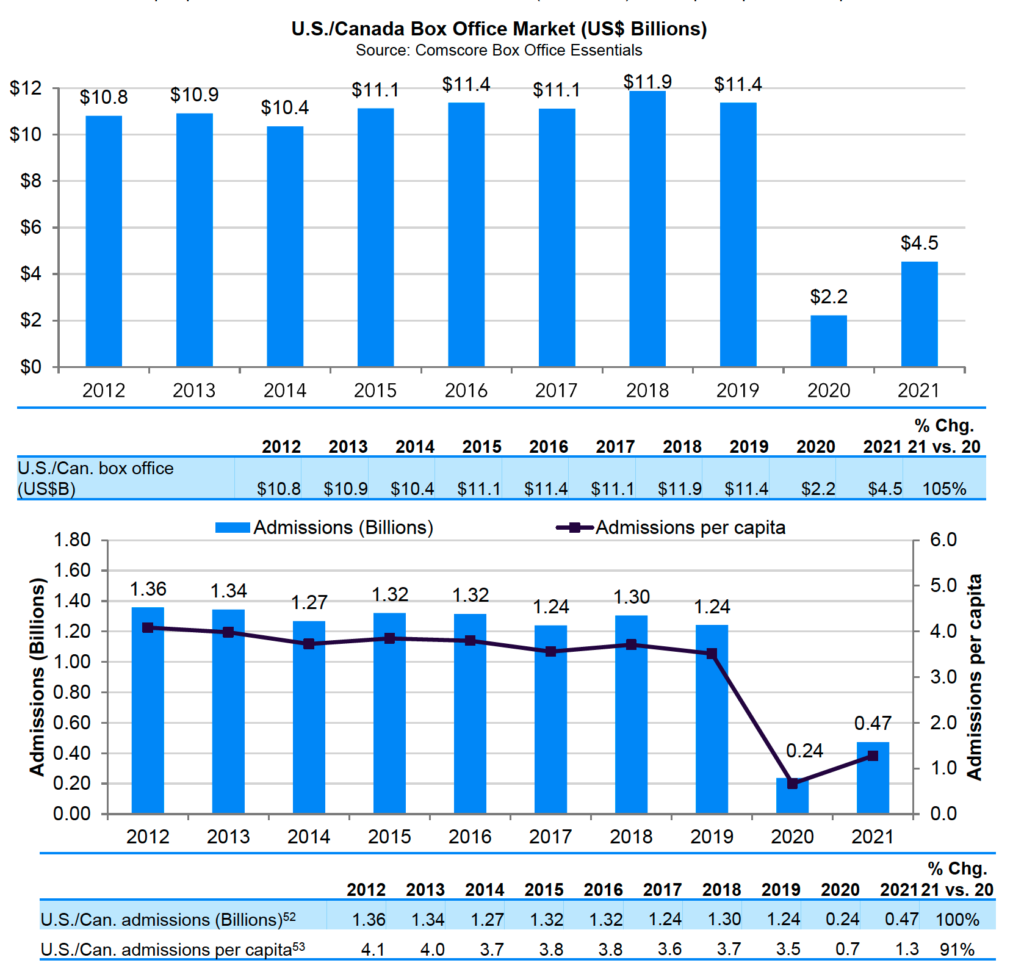

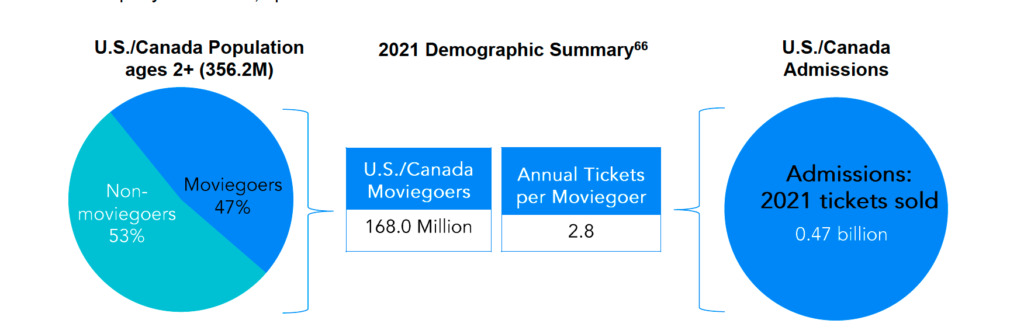

The North American domestic market (U.S. and Canada) finished the year in second place, with $4.5 billion, up 105 percent from the previous year. The number of tickets sold in North America (470 million) doubled in 2021, with just under half the U.S. and Canada population (168 million people) visiting a cinema at least once during the year.

The typical moviegoer in the domestic markets made an average of 2.8 cinema visits in 2021, up from 1.5 in 2020. Per capita attendance was highest among young audiences in the 12 to 17 age group (2.5 tickets sold per person) and among Hispanic/Latin American moviegoers (1.7). The gender composition of 2021 moviegoers in the domestic market skewed slightly male relative to the population share.

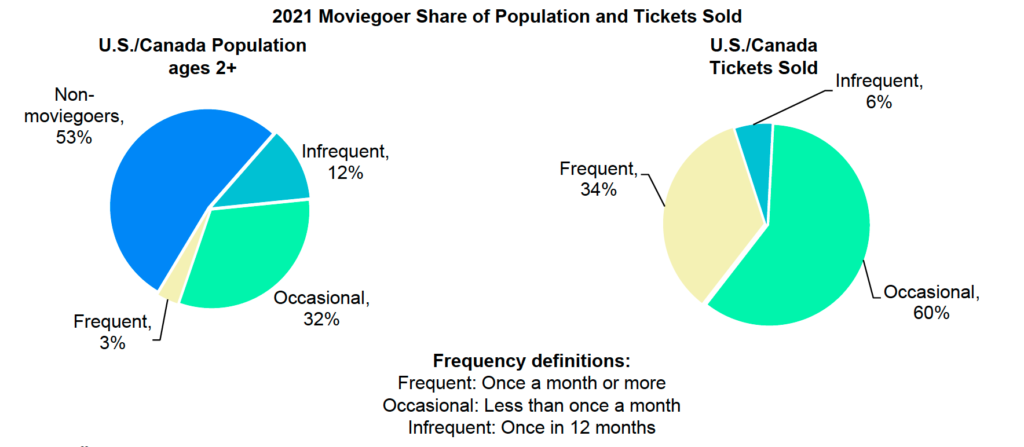

The number of domestic audiences who qualified as frequent moviegoers (with one or more admission per month) remained significantly lower when compared to 2019. Only 3 percent of the U.S. and Canada population recorded one or more cinema visits in 2021, the same figure as in 2020, down from 11 percent in 2019. That small share of the moviegoing public represented over a third of all domestic admissions in 2021 (34%). More than half of the public qualified as occasional moviegoers (60%), averaging less than one cinema visit per month.

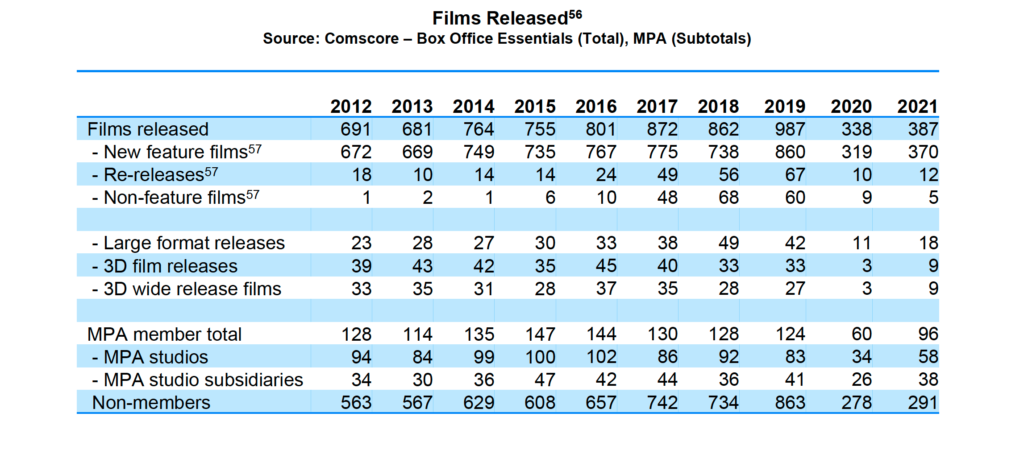

The slow return of audiences to habitual moviegoing can also be linked to the significant decrease of titles being released to cinemas. Only 387 titles reached theaters in 2021, slightly above the 319 released in 2020 and far behind the 987 films to have received a theatrical rollout in 2019. That 60 percent decline in the number of films released to theaters lines up perfectly with the 60 percent disparity in the box office performance of 2019 ($11.4 billion) and 2021 ($4.5 billion).

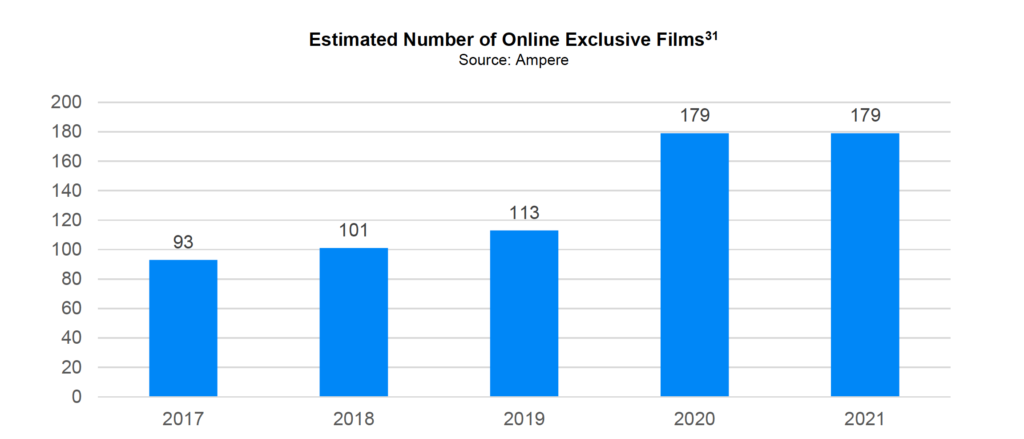

Despite the steep drop-off in the number of films made available to theaters, production bounced back up in 2021. A total of 943 films entered production in the United States over the course of last year, a 111 percent increase from 2020. The number of films released exclusively to streaming services remained unaffected, matching 2020’s high watermark of 179 titles. This includes titles from major brands like Pixar (Soul, Luca) and filmmakers like Steven Soderbergh (No Sudden Move) being made available exclusively on Disney Plus and HBO Max, respectively. The number of films exclusively available on streaming platforms has nearly doubled since 2017.

The pandemic has served as a catalyst to the adoption of subscription video on demand (SVOD) around the world. The number of streaming services subscriptions increased from 1.2 billion to 1.3 billion worldwide and from 308.6 million to 353.2 million in the United States, both representing a 14 percent increase from 2020. The rise of streaming pushed the global theatrical and home entertainment markets to revenues totaling $99.7 billion in 2021, a figure that rises to $328.2 billion when factoring in the pay TV market. In the United States, the combined theatrical and home entertainment market hit $36.8 billion in 2021, a 14 percent increase compared to 2020, and above the 2019 pre-pandemic benchmark of $36.1 billion.

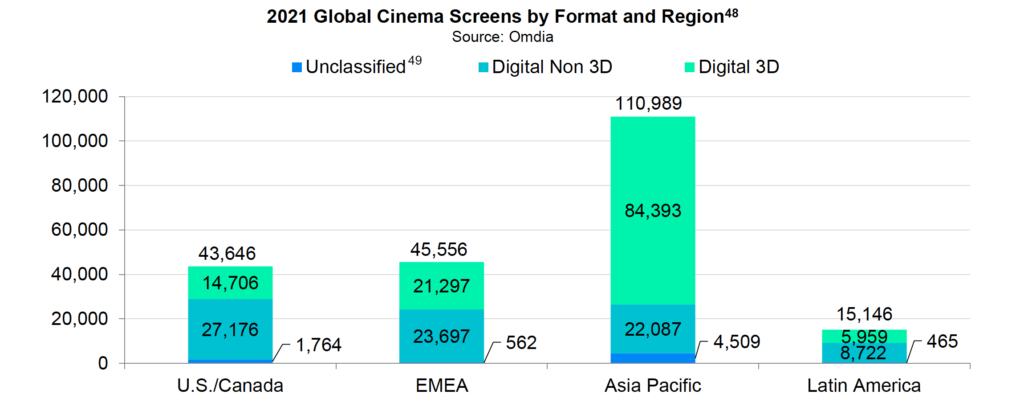

Fears that the pandemic would plunge the cinema industry into a global crisis have mostly subsided following a strong end to the year. The number of movie theater screens around the world is up 4 percent against 2019 figures, principally thanks to strong growth in the Asia Pacific region. The number of cinema screens in the United States and Canada has only decreased by 1 percent since 2019, from 44,283 to 43,646.

Share this post