Distribution and Exhibition Adjust to a Shifting Landscape in the Wake of Industry Consolidation

A video skit opened Paramount’s presentation at CinemaCon 2019 wherein studio chief Jim Gianopulos gets shepherded around different locations by a confused limo driver as he tries to arrive on time for his studio’s showcase. First up is CinemaKahn, a fan-fueled Star Trek convention, followed by CinemaDons, a Godfather-like conference for gangsters, and, finally, the appropriately named SinemaCon—where anything goes. The skit prompted scattered chuckles from the crowd at the Caesars Palace Colosseum, but it hinted at a larger truth that permeated the week-long event.

Gianopulos can be forgiven for having a hard time finding his bearings; in many ways, this year’s CinemaCon felt slightly different from previous editions. And how couldn’t it? As the dust settles behind a wave of consolidation, the future of the cinema business seems as promising—and fraught—as ever before.

That isn’t to imply the industry is undergoing a period of instability. Four consecutive years above $40 billion at the worldwide box office and coming off a record-setting $11.9 billion year in North America—there is ample proof in last year’s numbers that the business rests on a solid foundation.

The landscape, however, has been transformed by major M&A deals in both distribution and exhibition. Disney’s own CinemaCon presentation couldn’t have emphasized the audience’s disorientation more clearly; it not only touted its own slate—it also plugged titles from its acquisition of 20th Century Fox. Consolidation made its mark among mid-majors too, as CinemaCon formally introduced the exhibition community to the latest iteration of United Artists: a result of the merger between Annapurna and the recently revamped MGM. Other specialty players—Broad Green, Open Road, and The Weinstein Company—are no longer with us.

Exhibition has seen its own share of changes. Cineworld entered the North American market with its acquisition of Regal; Kinepolis did the same in acquiring Landmark Cinemas of Canada. Cinemex became one of the top exhibitors in the United States within a year of entering the market through the acquisition of Cobb Theatres under its CMX brand. Earlier this year, Marcus Theatres crossed the thousand-screen benchmark with its purchase of Movie Tavern.

The familiar players are all there, there are just fewer of them. At first glance, it seems the state of affairs under this “new normal” could lead to a decrease in content aimed at cinemas from studios. Fewer studios, after all, could theoretically mean fewer movies on the big screen—a worry amplified by the surge in original productions destined for streaming services.

NATO president and CEO John Fithian is confident that isn’t the case. At a press briefing following his State of the Industry remarks, the executive shared his belief that more platforms will help audiences get exposed to more content—creating ancillary programming opportunities for cinemas. Fithian cited the renaissance of documentaries at the box office as an example of this bump in public awareness. “The exhibition of documentaries slowed down to the point of dying in theaters,” he explained. “Netflix gave documentary filmmakers a platform to start making documentaries again and getting them seen … and people started coming back to documentaries in theaters.”

Case in point: Fourteen documentaries theatrically released in 2018 grossed over $1 million each. Among those, five earned over $12 million at the box office. The trend has kept up in the early months of 2019 with Neon’s Apollo 11 already reporting over $8 million in ticket sales. It isn’t a coincidence then that CinemaCon dedicated a panel session to the theatrical promotion of documentaries, with representatives from Alamo Drafthouse, AMC Theatres, Focus Features, and Neon all voicing their support for more titles to make their way to theaters. “As a specialty distributor, you have to have a slate that is diverse,” said Lisa Bunnell, president of distribution at Focus Features. “Documentaries are a part of that … just as important as any other films on your slate and deserving the same amount of respect, time, and effort.”

Bunnell’s call for a diverse slate is echoed throughout the industry, just as the virtual print fee (VPF) model, which has restricted programming at cinemas, is coming to an end. With 97 percent of the world’s 190,000 screens already converted to digital projection, exhibitors are finding more opportunities to schedule a wider range of titles.

Event cinema is one of the main benefactors of this development. The sector is coming off a fantastic 2018. New players like CineLife Entertainment (the alternative-content division of Spotlight Cinema Networks) entered the space with 15 titles in its first year alone. The most established player on the market, Fathom Events, celebrated a record year with 23 titles that grossed over $1 million—including the highest-grossing event cinema title of all time in the United States, They Shall Not Grow Old.

Alternative forms of distribution have also begun to take hold. Last year’s headlines on the topic centered on the launch of Nagra Kudelski’s MyCinema and GDC’s GoGoCinema, innovations that allow cinemas to directly book and exhibit content with greater flexibility. GDC’s GoGoCinema was originally announced as a cinema-on-demand service at last year’s CinemaCon, a solution that would allow moviegoers to drive demand for a specific title to their local movie theater. The service, which has not yet announced any titles or licensing partners, is scheduled to launch in China, Malaysia, and Singapore later this year.

Content will be key to the concept’s success. MyCinema’s strategy has revolved around providing a diverse slate of films with targeted marketing campaigns to engage different ethnic groups. The company has thus far found success with Hispanic moviegoers, who, according to the MPAA, are overrepresented in the population of frequent moviegoers (24%) relative to their proportion of the overall U.S. population (18%).

Despite this statistic, exhibitors like Moctesuma Esparza, CEO of Maya Cinemas, a circuit dedicated to building cinemas in underserved Hispanic neighborhoods, have struggled to find content representative of those audiences. “There are very few cinemas in Latino communities in the United States as compared to the 1930s, ’40s, and ’50s. When I was growing up, I could walk to the cinema and see movies from Hollywood or Mexico,” Esparza explained at a CinemaCon panel session on diversity. “It is a reflection of how our industry has changed … but it is beginning to turn around, and we’re getting more cinemas in these underserved areas. Now there have to be distributors willing to take on these movies and theaters willing to play them. It takes the entire cycle, and I am hopeful that it’s beginning to happen again.”

Tech solutions are slowly sprouting up to help address the issue. Just as Dolby and QSC currently offer accessibility products such as descriptive audio and captioning for patrons with disabilities, others have begun using similar steps to provide foreign-language tracks in their theaters. Mobile app TheaterEars allows moviegoers to access a Spanish-language soundtrack directly from their phones—at no cost to them or the theater. The app uses a phone’s microphone to first identify and sync a film with its official Spanish audio track, then allows viewers to listen with a pair of headphones. First Class Seating showcased a curious innovation at the CinemaCon 2019 trade show that would allow viewers to access a foreign-language track through a headphone jack built into the chair itself.

Diverse content from a more inclusive gamut of filmmakers is also emerging on streaming platforms, something NATO’s John Fithian says is an asset to cinemas. “Even though I represent the movie theater industry, it’s great that people like to watch movies and television shows on Netflix because people who love content love it everywhere,” he said at a press conference. His comments correlate with an EY study commissioned by NATO that shows that frequent moviegoers also tend to stream movies at home more often.

Whatever tension exists among cinemas with streaming services is less directed at any particular company than at their policy regarding theatrical exclusivity. While the rollout of Roma left a lot to be desired, it did signal at least a willingness from Netflix (or at least by director Alfonso Cuarón) to adopt a period of theatrical exclusivity. Some industry insiders remain confident the company will eventually adopt longer windows for theatrical releases. “I don’t look at Netflix as an enemy at all; our hope is to bring them in the tent,” said Tim Richards, CEO of Vue Cinemas, an outspoken critic of the limited theatrical rollout of Roma in the U.K.

Most importantly, Netflix is no longer the only major streamer around. More competition in the home entertainment market implies that future content is unlikely to be concentrated on a single platform. “They’re not the only game in town when it comes to streaming. There are going to be a lot of them,” Fithian said, citing new services from companies like Apple and Disney. “We’re looking at six major players—at least in North America, and with more coming around the world—that are going to give a home to content creators that can also help us in theaters.”

Distribution, exhibition, and home entertainment have all been impacted by this realignment in the entertainment industry. Vox Cinemas CEO Cameron Mitchell views the shift as beneficial to the industry as a whole. “If you go back two or three years, I was concerned about the industry because we had one really strong global exhibitor, multiple studios, and one really strong streaming platform,” he said in a panel session. “Jumping ahead to today, we have five or six massive international exhibitors, studio consolidation, and several influential streaming platforms. It feels like the equilibrium has been restored to a certain extent.”

This new balance of power is also driving a wave of innovation and investment from mid-tier companies looking to compete against the latest crop of larger multinational players. That is the case with Studio Movie Grill (SMG), which announced a $100 million investment from TowerBrook Capital Partners during CinemaCon. The funding is intended to help expand the dine-in chain across the United States and overseas. The Texas-based circuit currently operates 333 screens in the United States; it ranked 13th in Boxoffice’s latest Giants of Exhibition list of the biggest circuits in North America.

SMG founder and CEO Brian Schultz admitted in an interview with Boxoffice that the company looked at all its options before deciding to pursue a major expansion. “We went out and got funding because if we were going to continue growing, we had to do it right now when we’re in this intermediate space,” said the executive. “We’re too big to be considered a small independent, but we’re too small to be a major. So we made the decision to go big.”

Expansion isn’t the only avenue for growth in today’s exhibition business. Circuits of all sizes have dedicated significant sums in capex to update their circuits with premium amenities—including luxury seating, expanded concessions, and premium large format (PLF) auditoriums. While amenities like immersive seating often come with a price bump for the consumer, others like laser projection and immersive audio are often installed to raise the standard of the moviegoing experience.

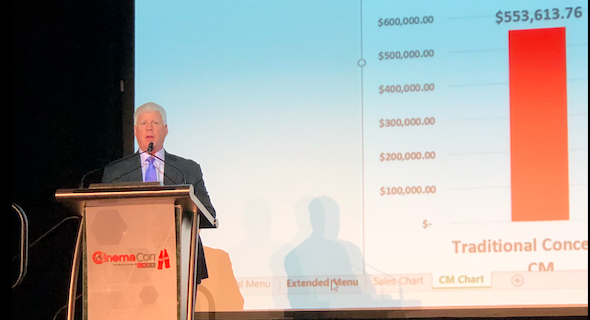

A stroll through the CinemaCon trade show hinted at an overwhelming odyssey for exhibitors looking to upgrade their sites. And while the allure of an increased concessions per cap might drive some theater owners to invest in new equipment, a study by the University of Memphis, commissioned by the National Association of Concessionaires (NAC), revealed that the immediate benefits of expanded F&B offerings are somewhat limited. “We realized people aren’t coming to the movies more because we offer extended or full menus,” said Larry Etter, an SVP at Malco Theatres and director of education at NAC, when presenting the study’s results. “Sure, it’s a nice amenity—but for me, it was one of those ‘Duh!’ moments: Why do people go to the movies? They come for the product on your screens. They’re coming to see movies.” Rather than viewing expanded concessions as an evolution of the moviegoing experience, Etter regards the trend as an example of exhibition raising the standard of its offering to consumers. “As operators and exhibitors, once we get them in the building we need to ask ourselves: How do we keep them entertained and make that entire package better than it’s been for the last 10 years?”

Raising that standard is integral for Vue CEO Tim Richards, who mentioned the decline of U.K. cinema admissions in the postwar period as a result of a lack of investment. Vowing to avoid the same mistakes, Richards has prioritized maintaining an up-to-date circuit in several key areas. “For us at Vue, we took things to a back-to-basics mode: looking at seats, sight, and sound,” said Richards in a panel discussion. “Our investment has been focused on trying to enhance that experience for customers.”

Other premium amenities, like PLF and immersive seating, are designed to drive higher ticket prices. The proliferation of these formats in the last half-decade has to be considered alongside the decline of 3-D box office revenue in recent years. Global box office for 3-D titles has declined by 20 percent since 2015. On the other hand, IHS reports the number of PLF auditoriums worldwide has more than doubled in the last three years. Simply stating that 3-D’s box office impact is in decline is only half the story. The rise of PLF and immersive seating shows that premium pricing at cinemas isn’t being eradicated—it’s diversifying.

Jed Harmsen, senior director of worldwide cinema and content solutions at Dolby, has seen that shift firsthand over the last half-decade. “Five years ago, [Dolby Cinema] was a technology demonstration to show people what we were working on,” says the executive of the launch of Dolby’s branded PLF solution featuring its Dolby Vision image and Dolby Atmos audio technology. “Now here we are, five years later, with 200 locations installed across 11 countries—and we have another 200 that have already been committed.”

Other tech companies have stepped up to deliver their own branded PLF solutions to rival Imax and Dolby Cinema. On the eve of CinemaCon 2019, THX announced the opening of its first branded PLF auditorium, THX Ultimate Cinema, at Regency’s historic Westwood Village Theatre in Los Angeles—an iconic movie house originally opened in 1930 as the Fox Theater. The company partnered with Cinionic to give its PLF solution dual-laser projection and immersive audio that meets THX certification standards.

Sony leveraged its CinemaCon presence to inaugurate the first Sony Digital Cinema PLF auditorium at Galaxy Theatres’ new Las Vegas location. Equipped with Dolby Atmos sound and Sony 4K laser projection, it offers a glimpse into a new competitive landscape for branded PLF solutions as it joins competitors like Imax, Dolby, RealD, and THX for a share of the premium-theater market.

Rather than opting to self-brand an entire PLF solution, Samsung is allowing exhibitor clients to choose how to promote their Onyx LED cinema screen in their theaters. The company claims to have 34 LED screens already installed around the world, with five additional committed in 2019. Two of those commitments are in the United States: a 46-foot-wide screen at an upcoming location of Star Cinema Grill, a Houston-based dine-in circuit, and a 34-foot-wide version for an innovative premium auditorium in Baltimore’s Warehouse Cinemas. That PLF concept will be known as “SkyVUE” and will take full advantage of the Onyx’s LED technology. Since Samsung’s screen doesn’t require a projection booth, moviegoers will enter a flat auditorium (goodbye, stadium seating) with an elevated screen that’s tilted forward to give viewers a uniquely ergonomic viewing experience.

While some industry analysts question whether this saturation of PLF solutions could have an adverse effect on cinemas and vendors alike, Dolby’s Harmsen sees the competition as a positive development. “As an industry, we need to continue investing in differentiated cinematic presentations to continue to drive viewership growth,” says the Dolby executive. “Many millennials, Gen Z—however you want to bracket younger audiences—still desire that communal cinema experience; it’s hard to replicate. But they want to make sure that they’re getting something out of it. So, when I see a lot of people getting into the PLF space, to me it’s a validation that the industry is choosing to invest in improving and differentiating the moviegoing experience.”

CJ 4DPLEX is one of the leading innovators in providing audiences those unique experiences. The company’s immersive seating technology, 4DX, and panoramic screen, ScreenX, were the biggest story of last year’s CinemaCon when they announced a major deal with Cineworld that would significantly expand its footprint in the United States at Regal locations nationwide. This year, the company followed up that traction with business deals that will expand the 4DX footprint in new markets like Saudi Arabia and establish an increased presence for ScreenX in markets like Canada, with Cineplex, and India, with INOX and PVR. The company’s fully immersive solution, ScreenX with 4DX, which combines the panoramic screen with immersive seats, will be making its way to Latin America at Cinépolis locations beginning later this year.

French circuit CGR has begun licensing its own immersive screen solution, ICE Light Vibes, to other cinemas after a successful run in its home country, where it has already reported higher grosses than Imax screens nationwide. That expansion ramps up later this year, when ICE begins to make its way to Vox locations in the Middle East.

On the immersive seating side, Canada’s D-Box celebrated its 10th anniversary providing immersive seating to cinemas this year by announcing a slew of high-profile deals with major players at CinemaCon. Its partnership with compatriot circuit Cineplex will be extended with the addition of 10 new auditoriums in Canada, and the company will be opening its first four auditoriums for Hoyts in select locations in Australia. D-Box announced its biggest deal of the week in a special signing ceremony at CinemaCon, where CEO Claude McMaster joined PVR President & CEO Gautam Dutta to reveal plans that will add over 400 D-Box seats and recliners to PVR locations in Delhi and Mumbai.

For its own part, MediaMation’s MX4D technology found similar success at this year’s event by announcing new deals that expand its footprint across five continents through partners that include the likes of B&B Theatres, Cine Colombia, and Nigeria’s Film House Cinemas. The MX4D booth at CinemaCon featured an exclusive demo of Sony’s Haptics Technology—an immersive cinema prototype consisting of a vest that moviegoers wear over their clothes once inside the auditorium. The MX4D’s seat effects are complemented by a coded vibration system on the vest synced to the film. The technology has only had a limited week-long trial run in Japan, and the technology is expected to further develop before going to market. It’s admittedly more of a curiosity than a product at this stage—but it wasn’t that long ago when moving chairs with air and water effects were regarded the same way. Today, immersive seating has received the backing of nearly every major exhibitor around the world.

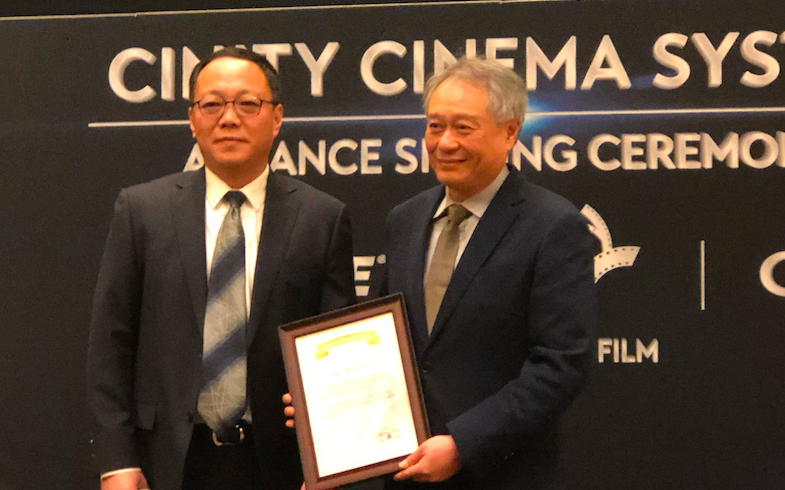

All this technology means little if there’s no content to exploit it. Warner Bros. announced at CinemaCon that it would be providing titles especially coded for enhanced-seating cinemas through 2019. At a small Las Vegas reception that same week, leading Chinese distributor Huaxia announced it would be entering into an alliance with cinema tech providers Christie and GDC to promote the production of advance-format films that can help push adoption of high frame rate (HFR) and high dynamic range (HDR) titles. Addressing that reception was filmmaker Ang Lee, who called his experience making Life of Pi in cutting-edge 3-D technology “the beginning of something completely new in cinema.” Paramount will be releasing Lee’s Gemini Man later this year, a 3-D title shot at 120 frames per second. Lee joins the alliance as its first mentor filmmaker in a program dedicated to making these technologies more available to the next generation of directors.

These premium formats are intended to complement cinemas’ existing investment in 3-D technology and provide moviegoers additional options to customize their moviegoing experience. Exhibitors’ ultimate hope is that these innovations can help drive both attendance and frequency; a 5 percent bump in domestic admissions suggests the strategy might be working.

Premium amenities aren’t the only innovation behind last year’s admissions growth. The rapid rise—and subsequent fall—of MoviePass in 2018 helped clarify two important things for the exhibition community: 1) Consumers are interested in cinema subscription services, and 2) cinema subscriptions are only as good as their business model. A new crop of companies emerged in the wake of MoviePass and Sinemia to offer their own third-party and white-label subscription solutions, most notably digital ticketing start-up Atom Tickets and ticketing solutions provider Influx Worldwide.

Jerome Seydoux, chairman and CEO of Les Cinémas Pathé Gaumont, admitted in a roundtable discussion that his circuit has benefited strongly from its own subscription scheme. According to the executive, subscriptions account for approximately 25 percent of Pathé’s admissions in the Netherlands and 20 percent in France. The allure of subscription isn’t limited to achieving a higher frequency of visits from patrons, but of collecting—and controlling—the consumer data that comes along with those increased visits. While majors like AMC and Cinemark have already launched their own in-house services in the United States, many other circuits are taking a wait-and-see attitude as to which, if any, solution to adopt.

Will Palmer, CEO of cinema analytics firm Movio, has evangelized the importance of data collection for years and says he believes the industry is headed in the right direction. “There’s been a massive movement towards data collection,” Palmer told Boxoffice. “There aren’t many significant cinema chains today that are not actively collecting data through a loyalty program, online ticket sales or some other medium.”

What cinemas do with that data, however, can make all the difference in the world. Implementing a strategy to best utilize consumer data is quickly becoming a challenge for exhibitors. Pathé’s Seydoux highlighted the issue in his panel, “We know a lot about our customers; what we have to learn next is how to use all the data we have.”

Exhibitors aren’t the only industry players concerned with what the future of data collection holds. Cinema advertising leader NCM recently ramped up its own efforts in data collection by making its pre-show more engaging for viewers through their mobile phones. The hope is that by gamifying the pre-show through its Noovie Arcade app, NCM will be able to better identify and reach their moviegoers. “Data is driving more decisions in the movie industry than ever before,” NCM president Cliff Marks told Boxoffice. “The challenge is that everybody has their own data; there’s no universal platform.”

As the industry gets better at learning more about their customers, Marks is concerned about what he calls “data silos,” with every individual company harboring data for exclusive use. “I don’t know how to get past these silos of data,” he said. “Every company sees that as one of their most precious assets. But at the end of the day, we would all win by sharing our data and using it to draw more people to the movies.”

The next step in cinema’s data revolution will be using consumer behavior to help draw in new audiences. “We’re very good at targeting customers that are coming. We’re not very good at targeting customers that aren’t coming,” admitted Vox CEO Cameron Mitchell in his panel discussion. Doing so is going to require comprehensive effort—fusing together a pipeline of diverse content while leveraging investments in sight, sound, and seating technology—all at the right price. Marine Suttle, SVP and chief product officer at Webedia Movies Pro, summed it up during an AI panel at CinemaCon. “The next step is finding the right method of targeting non-moviegoers with the right offer—expanded concessions, variable pricing, and so on—to get back into theaters,” she said.

It’s disingenuous to suggest all this will play a role in some distant future. On the final day of CinemaCon 2019, a 20-minute drive from Caesars Palace and the lights of the Las Vegas strip, Galaxy Theatres celebrated the opening of its newest location. Situated in a suburban shopping plaza mostly frequented by local families, Galaxy’s Boulevard Mall location isn’t a glimpse into the future of cinema, but to its present. In the lobby, a bar area welcomes patrons with alcohol service and an expanded concessions menu with combo deals promoted on dynamic digital signage. Every auditorium of the nine-screen complex is outfitted with Sony 4K laser projection and luxury Encore recliners by Palliser. Three of the auditoriums have a premium attached: one with several rows of D-Box immersive recliners, an exhibitor-branded PLF auditorium, and the third plays host to the world’s first Sony-branded PLF—each with Dolby Atmos sound. There isn’t a bad seat in the house; every front row in the theater has a fully reclined loveseat.

New builds like Galaxy’s—along with the PLF concepts from Baltimore’s Warehouse Cinemas or Houston’s Star Cinema Grill described earlier—aren’t anchoring sprawling multiplexes in major cities. Increasingly, these are theaters targeting average moviegoers in suburban areas. It brings to mind the tagline that serves as the mission statement of family-owned B&B Theatres (currently the eighth largest in North America): “Bringing Hollywood to your hometown.” Like the chains mentioned above, B&B has invested considerably in state-of-the-art locations—featuring premiums like ScreenX and MX4D—in new builds in towns such as Liberty, Missouri, and Ankeny, Iowa.

For those of us attending the grand opening of Galaxy’s new Las Vegas location, it summed up what many were already feeling back at Caesars Palace but found hard to articulate. The industry isn’t on the verge of another major transformation; it’s in the midst of one.

Share this post