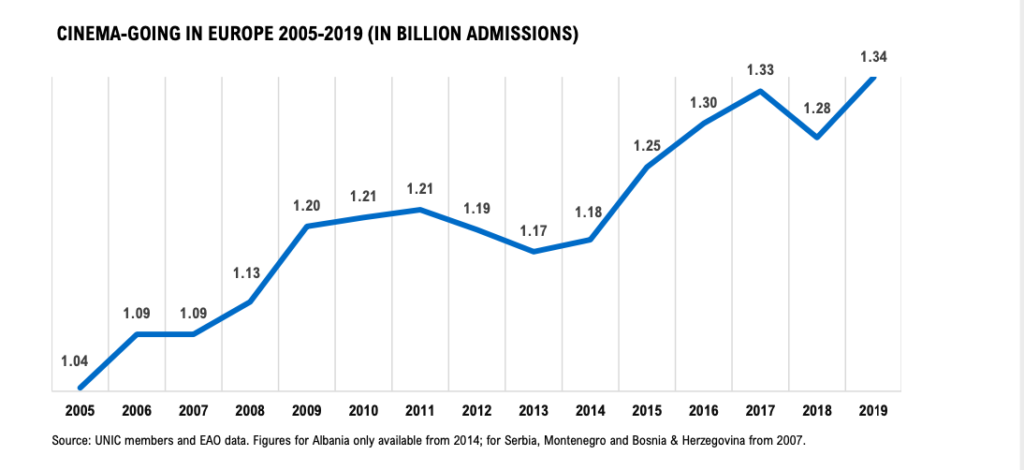

The International Union of Cinemas (UNIC), Europe’s trade body representing the region’s cinema trade associations and operators, has released early numbers indicating a record 1.34 billion admissions to its member cinemas in 2019.

While data for some territories is estimated, UNIC’s overview represents the first wide-ranging assessment of the performance of the European cinema sector in 2019. The trade body will release detailed final data on each territory’s performance this spring.

RECORD-BREAKING YEAR FOR CINEMAS ACROSS EUROPE

European cinema admissions increased by 4.5 percent in 2019, setting a record of over 1.34 billion visits across the region. In the European Union, cinemas recorded their best results for 15 years, with admissions reaching the 1 billion mark for the first time since 2004.

While final figures for several territories are still pending, estimates indicate that total box office for Europe will pass the €8.5 billion mark, an increase of 6.25 percent from 2018’s €8.0 billion. For the EU, estimates indicate over €7.1 billion in box office revenue compared to last year’s €6.8, a 4.41 percent increase.

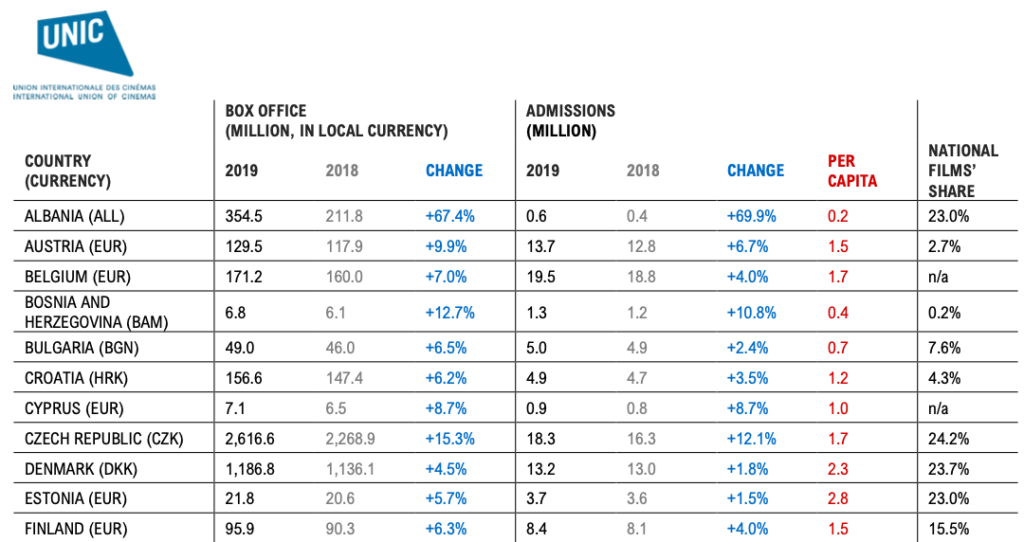

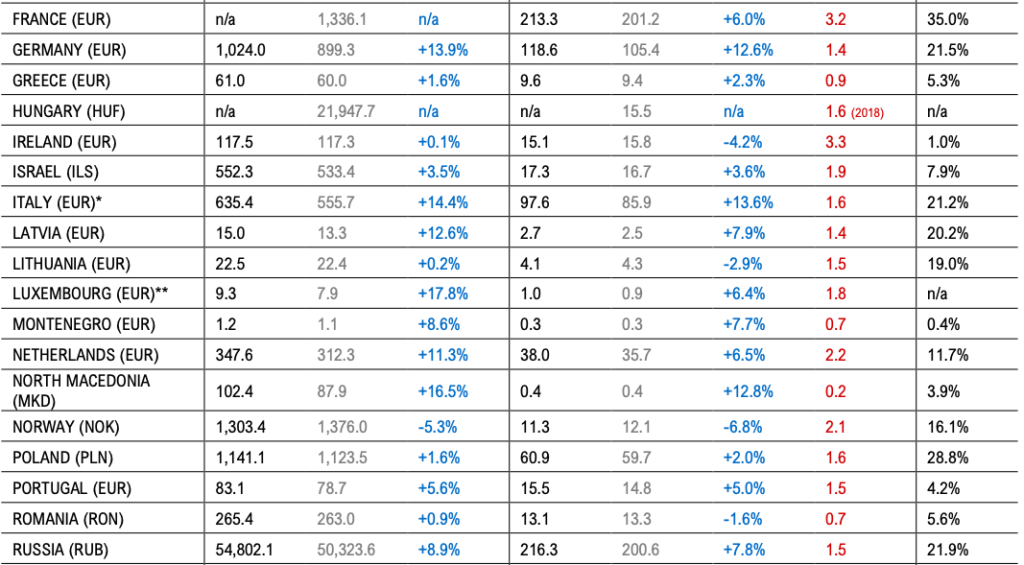

Strong Showing in Russia, France, and the UK

Russian cinemas led all European territories in admissions, attracting a record 216.3 million visitors in 2019. This is the third consecutive year where admissions in Russia have crossed 200 million. France placed second in Europe with 213.3 million cinema visits in 2019, its second-best performance since 1966. The UK, the third biggest European cinema market in terms of admissions, grossed over £1.25 billion at the box office–equating to a European-high €1.48 billion – following a record-breaking 2018.

Recovery in Germany and Across Western Europe

Following a difficult 2018, admissions in Germany bounced back with a 12.6 percent improvement. Several other markets across Western Europe also made up lost ground against 2018, including Austria (6.7%) and Switzerland (6.3%). The Netherlands is also worth highlighting, as the local industry has been growing at a steady pace over the past decades to reach a record 38 million admissions in 2019.

Growth in Spain, Portugal and Italy

The Spanish cinema industry enjoyed its best performance since 2009, surpassing 100 million admissions. Spanish exhibitors managed to increase admissions by 37 percent compared to 2013, when an entertainment tax placed on cinema tickets sent the industry into a tailspin. Following a challenging 2018, the Portuguese industry enjoyed a year of growth, increasing box office by 5.6 percent and admissions by 5 percent. Portugal surpassed the 15 million admissions mark for the second time since 2011. In Italy, final admissions figures are expected to exceed 100 million visits, while box office grew 14.4 percent.

Mixed Fortunes in Scandinavia

Denmark (box office up 4.5 percent, admissions up 1.8 percent) and Finland (box office up 6.3 per cent, admissions up 4 percent) enjoyed good growth respectively, bolstered by successful local titles that ranked among each country’s top five box office hits of the year. On the other hand, Sweden (box office down 0.9 percent, admissions down 2.9 percent) and Norway (box office down 5.3 per cent, admissions down 6.8 percent) were among the European territories to suffer decreases in 2019, partly due to a lack of breakthrough local titles at the box office.

Thriving Local Industries in CEE, Baltic States, and Southern Europe

Local titles helped Poland and the Czech Republic reach new heights in admissions and box office in 2019. Poland welcomed a record-breaking 60.9 million moviegoers last year, fueling a 63 percent growth in the territory since 2010. Positive results were also reported in Bulgaria (box office up 6.5 percent, admissions up 2.4 percent), Ukraine (box office and admissions each up 7 percent) and Slovakia (box office up 12.8 per cent, admissions up 9.3 percent), where admissions tripled in the last 15 years.

The success of the cinema industry across the Baltics is worth highlighting, as Estonia and Latvia attracted record admissions while Lithuania achieved its second-best performance ever, following a strong 2018. All three territories had a local title leading the box office. Similarly, the cinema industry in the Balkans is growing at an increasing pace, with Bosnia and Herzegovina, Montenegro, Serbia and Croatia all enjoying their highest levels of cinema admissions ever, while Slovenia recorded its best results since 2012. Albanians supported their nascent cinema industry in 2019, with a 69.9 per cent increase in admissions, also carried by the incredibly successful local production 2 Gisht Mjaltë. Meanwhile, cinema admissions in Turkey decreased significantly in 2019 due to local industry spats. An increased average ticket price resulted in a box office bump, though currency conversion rates indicate a decrease of box office returns in Euro.

Admissions per Capita and National Films’ Share

Admissions per capita for all UNIC territories with available data remained stable at 1.5 average visits per year. Ireland and France (at 3.3 and 3.2 respectively) experienced the highest rates of cinema-going once again, followed by Estonia (2.8), the UK (2.7), and Denmark and Spain (both at 2.3).

Total market share for European films in 2019 will be available once final data on each territory is published. Turkey (54%), France (35%) and Poland (28.8%) once again experienced the highest national films’ market share across UNIC territories, as the Czech Republic, Denmark, Albania, Estonia, Russia, Germany, Italy and Latvia all managed a national films’ market share of above 20 percent.

Share this post